2016 Eic Table

Then go to the column that includes your filing status and the number of qualifying children you have.

2016 eic table. Investment income limit investment income must be 3650 or less for the year. Then go to the column that includes your filing status and the number of qualifying children you have. Form 1040 schedule. After you have figured your earned income credit eic use schedule eic to give the irs information about your qualifying children.

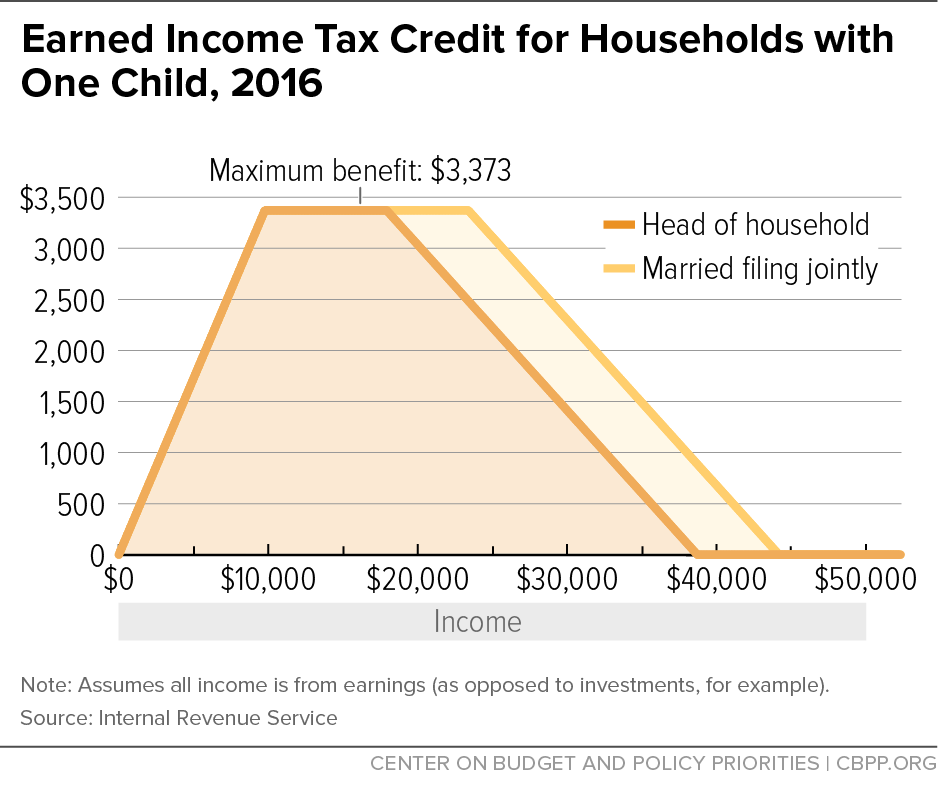

A married per son filing a joint return may get more eic than someone with the same income but a different filing status. To find your credit read down the at least but less than columns and find the line that includes the amount you were told to look up from your eic worksheet. 2016 earned income credit eic table. Enter the credit from that column on your eic.

Disallowance of the eic. Enter the credit from that column on your eic. This is not a tax table. Increased eic on certain joint returns.

This is not a tax table. To find your credit read down the at least but less than columns and find the line that includes the amount you were told to look up from your eic worksheet. Eic not a qualifying child. Maximum credit amounts the maximum amount of credit for tax year 2020 is.

To figure the amount of your credit or to have the irs figure it for you see the instructions for form 1040a lines 42a and 42b or form 1040 lines 66a and 66b. 2016 earned income credit eic tablecaution. The eic on either your original or an amended 2016 return even if that child later gets an ssn. Read down the at leastbut less than columns and find the line that includes the amount you were told to look up from your eic worksheet earlier.

This is not a tax table. Do i have to have a child to qualify for the eic. Earned income tax credit eitc eic and child tax credit. 2016 earned income credit eic table caution.

This is not a tax table. As a re sult the eic table has different columns for married per. Can i claim the eic. Follow the two steps below to find your credit.

Do you qualify for the eic. Publication 596 earned income credit. This is not a tax table. Claiming the eic if i dont have a qualifying child.

2016 earned income credit eic table caution. 2018 earned income credit eic table caution. If you take the eic even though you are not eligible and it is. 2013 earned income credit eic table caution.

At least but less than singlemarried ling jointly married ling sepa rately head of a house hold your taxis 25200 25250 25300 25350 2833 2839 2845 2851 sample table 25250 25300 25350 25400 2639 2645 2651 2657 2833 2839. Taking the eic when not eligible. Then go to the column that includes your filing status and the number of qualifying children you have. To find your credit read down the at least but less than columns and find the line that includes the amount you were told to look up from your eic worksheet.

Forms and instructions. Claiming the eic if i have a qualifying child.