California Tax Tables 2017

This means that these brackets applied to all income earned in 2016 and the tax return that uses these tax rates was due in april 2017.

California tax tables 2017. If you are in doubt about the correct rate or if you cannot find a community please call our toll free number 1 800 400 7115 tty711 or call the local board of equalization boe office near you for assistance. If so no income tax is required to be withheld. Some communities located within a county or a city may not be listed. Marriedrdp filing jointly or qualifying widower joint.

To figure your tax online go to ftbcagovtax rates. Step 1 determine if the employees gross wages are less than or equal to the amount shown in table 1 low income exemption table. Calculate your state income tax step by step 6. Form 540 and 540 nr.

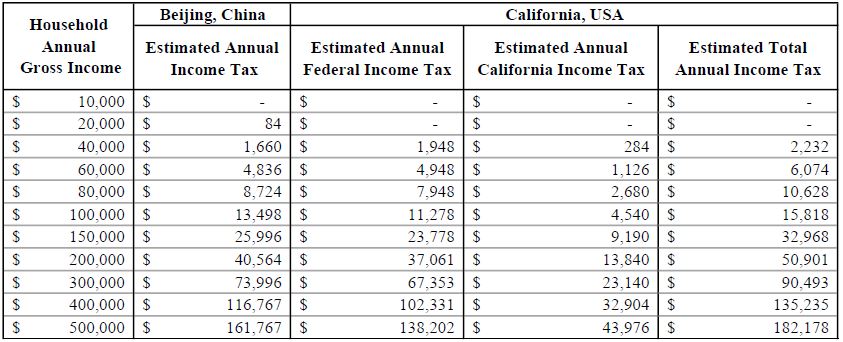

If you want to simplify payroll tax calculations you can download ezpaycheck payroll software which can calculate federal tax state tax medicare tax social security tax and other taxes for you automatically. In the following table we provide the most up to date data available on state individual income tax rates brackets standard deductions and personal exemptions for both single and joint filers. California withholding schedules for 2017 method a wage bracket table method to determine the amount of tax to be withheld follow these steps. Notable individual income tax changes in 2017.

California withholding schedules for 2017 california provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax. Head of household head head of household. Head of household head head of household. 2017 california income tax.

2017 california tax rate schedules. You can try it free for 30 days with no obligation and no credt card needed. Method a wage bracket table method limited to wagessalaries less than 1 million method b exact calculation method method a provides a quick and easy way to select the appropriate withholding amount based on. To amend from separate tax returns to a joint tax return follow the form 540 instructions to complete only one amended tax return.

To e file and eliminate the math go to ftbcagov. Check the 2017 california state tax rate and the rules to calculate state income tax 5. Both you and your spouserdp must sign the amended joint tax return. Find prior year tax tables using the forms and publications search.

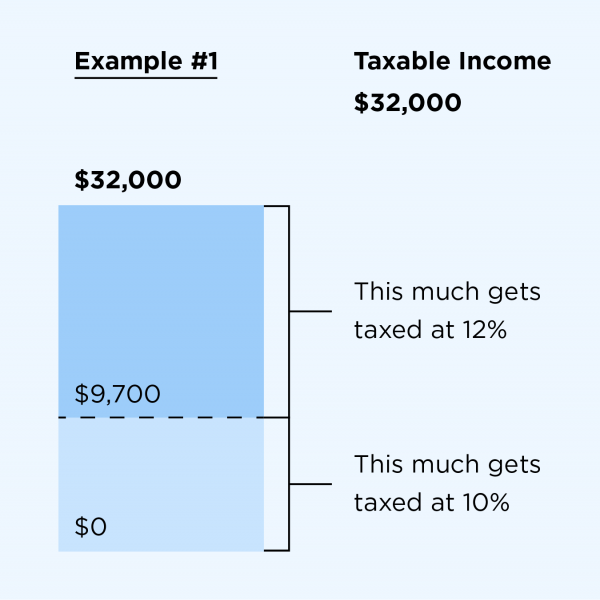

What you need to know heres how californias income tax system works so you can figure out how much you may need to pay. Several states changed key features of their individual income tax codes between 2016 and 2017.