Eic Tax Table 2020

Can i claim the eic.

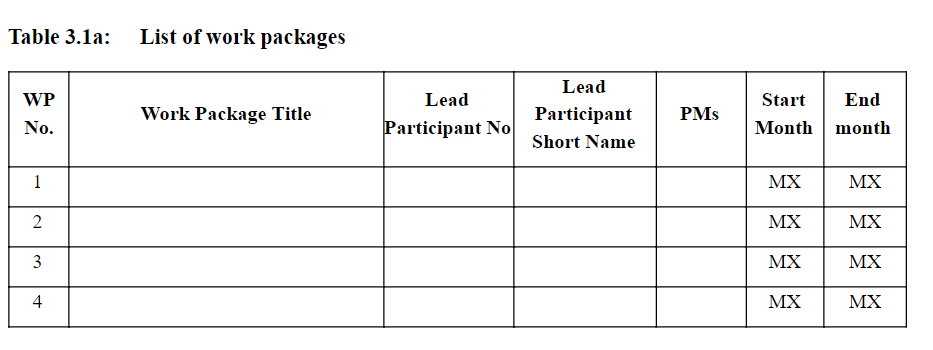

Eic tax table 2020. 24327a 2 0 1 9 tax year tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr. Earned income credit in a nutshell. People who work and have earned income under 55952. 6660 with three or more qualifying children.

So i thought i should provide a basic overview of what the earned income credit is including qualifications qualified children rules maximum credit amount income limits income tables. See the earned income tax credit table or calculator below to see the maximum amount of the eitc allowed. Eitc reduces the amount of tax you owe and may give you a refund. Irs announcing changes to earned income tax credit.

It s fast simple and secure. The earned income tax credit eitc or eic is a benefit for working people with low to moderate income. 5920 with two qualifying children. The eic may also give you a refund.

The credit has increased for joint filing taxpayers with three or more qualifying children. To claim the eic you must meet certain rules. The maximum amount of credit for tax year 2020 is. See the eic earned income credit table amounts and how you can claim this valuable tax credit.

Here is the most current eic earned income credit table. The calculation of the earned income amount has not changed much. 3584 with one qualifying child. These rules are summarized in table 1.

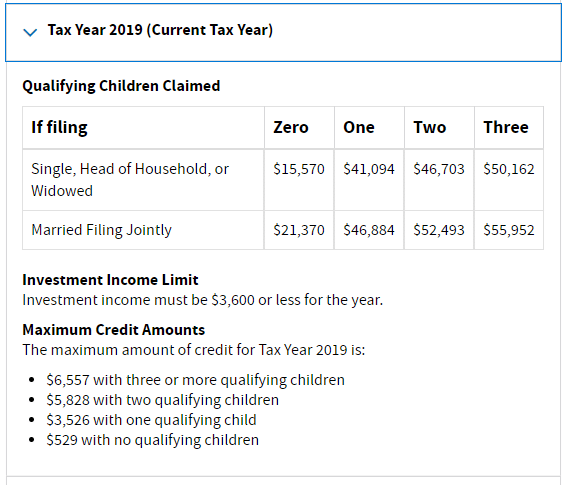

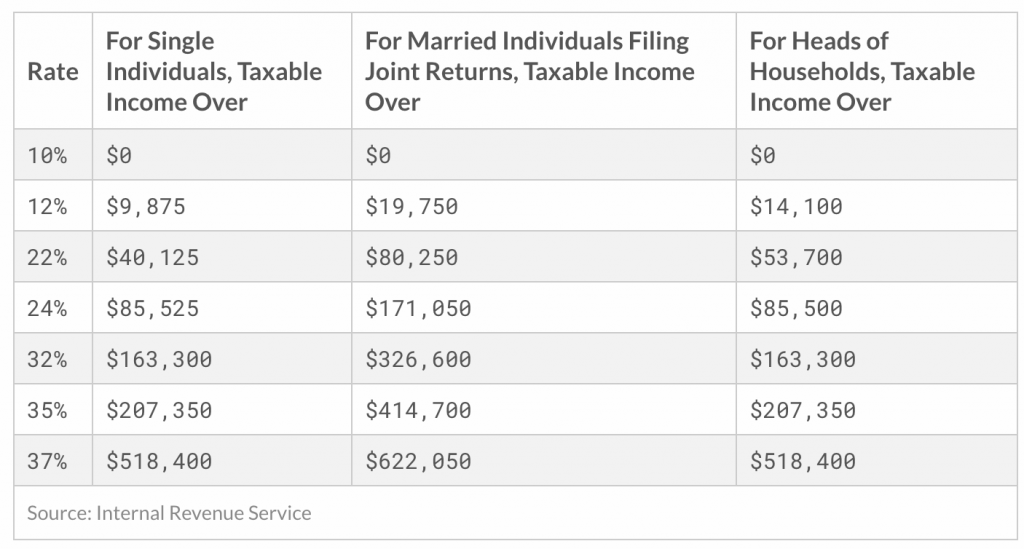

You will not be eligible if you earned over 5488400 or if you had investment income that exceeded 310000. This booklet does not contain. To qualify you must meet certain requirements and file a tax return even if you do not owe any tax or are not required to file. The earned income tax credit is available to claim for the 2019 2020 tax season.

A tax credit usually means more money in your pocket. Changes to earned income credit table eitc will be announced over the summer months and into the fall of 2018. It is also simultaneously one of the most complicated and popular tax credits as well. The earned income tax credit eitc is one of the most significant tax credits available in the entire irs tax code.

538 with no qualifying children. Jan 22 2020 cat. The earned income tax credit eitc or eic has some changes implemented in 2018. The credit maxes out at 3 or more dependents.

It reduces the amount of tax you owe.