2017 Federal Tax Tables

Publication 17 your federal income tax for individuals 2017 tax tables.

2017 federal tax tables. At least but less than singlemarried ling jointly married ling sepa rately head of a house hold your taxis 25200 25250 25300 25350 3318 3325 3333 3340 sample table 25250 25300 25350 25400 2851 2859 2866 2874 3318 3325 3333 3340 3116 3124 3131 3139 example. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. 2017 tax table k. At least but less than singlemarried ling jointly married ling sepa rately head of a house hold your taxis 25200 25250 25300 25350 2833 2839 2845 2851 sample table 25250 25300 25350 25400 2639 2645 2651 2657 2833 2839.

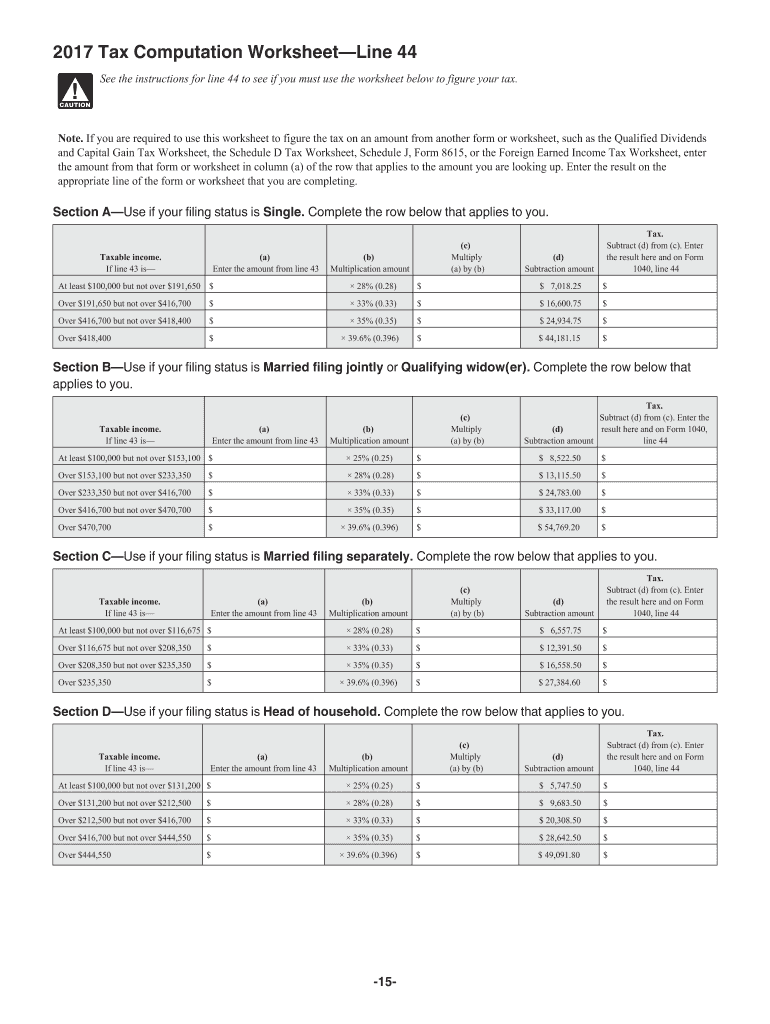

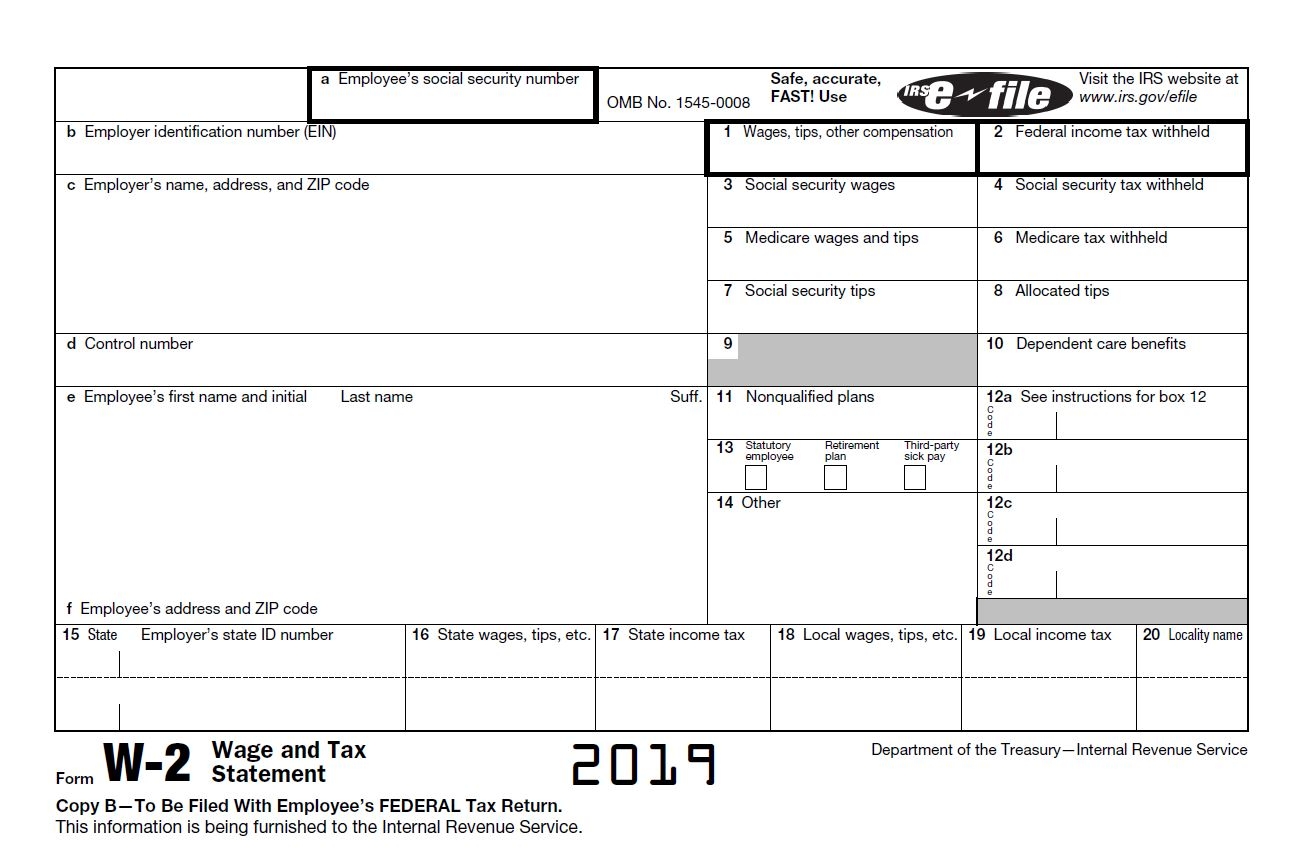

Individual income tax return. 2017 tax table253 2017 tax computation worksheet265 2017 tax rate. Federal income tax rate 2017 income tax rates for taxes due april 17th 2018. Federal income tax rates broken down by filing status.

2017tax table see the instructions for line 44 in the instructions for form 1040 to see if. In 2017 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. Tax table and tax rate schedules. 2017 federal tax tables with 2020 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.

See the instructions for line 12a to see if you must use the tax table below to figure your tax. Instructions for form 1040 us. Tax tables form 1040 instructions html. 2017 and 2018 tax tables and 2017 and 2018 tax brackets for you to use in tax planning.

The top marginal income tax rate of 396 percent will hit taxpayers with taxable income of 418400 and higher for single filers and 470700 and higher for married couples filing jointly. See the instructions for line 44 to see if you must use the tax table below to figure your tax. Citation to your federal income tax 2017 would be appropriate. Individual income tax return.

Prior year tax tables forms and instructions. 1040 tax and earned income credit tables introductory material 1040 tax and earned income credit tables main contents tax table. This publication covers some subjects on which a court may have made a decision more favorable to taxpayers than the interpretation by the irs.