2020 Tax Tables

Subsistence allowances and advances.

2020 tax tables. They are not the numbers and tables that youll use to prepare your 2019 tax returns in 2020 youll find them here. Publication 15 t will be posted on irsgov in december 2019 as will publication 15 employers tax guide. 37 062 26 of taxable income above 205 900. Latest thinking tax calculators rates.

Below are early release copies of percentage method tables for automated payroll systems that will appear in publication 15 t federal income tax withholding methods for use in 2020. These are the numbers for the tax year 2020 beginning january 1 2020. Read more read less. 321 601 445 100.

2020 federal tax tables the inland revenue service irs is responsible for publishing the latest tax tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. 10 tax rate up to 9875 for singles up to 19750 for joint filers 12 tax rate up to 40125. Rates of tax for individuals. Tax deduction tables currently selected.

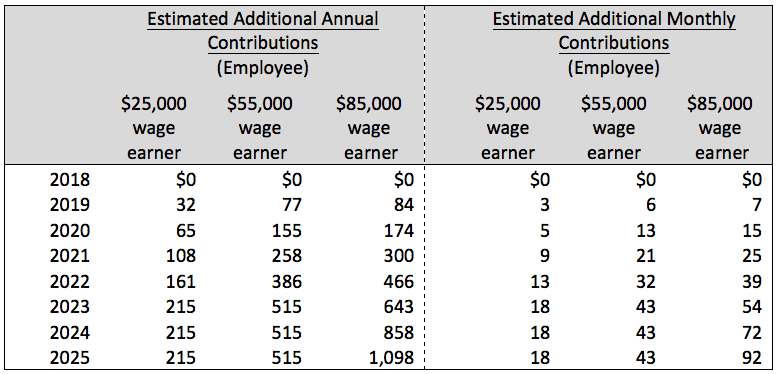

2020 income tax in canada is calculated separately for federal tax commitments and province tax commitments depending on where the individual tax return is filed in 2020 due to work location. Also the amounts from the tables dont increase the social security tax or medicare tax liability of the employer or the employee or the futa tax liability of the employer. 18 of taxable income. Calculate your combined federal and provincial tax bill in each province and territory.

Eys tax calculators and rate tables help simplify the tax process for you by making it easy to figure out how much tax you pay. 2021 1 march 2020 28 february 2021 weekly tax deduction tables fortnightly tax deduction tables monthly tax deduction tables annual tax deduction tables other employment tax deduction. Medical tax credit rates. Sars home tax rates employers tax deduction tables.

Rates per kilometer. An employer pays wages of 300 for a weekly payroll period to a married nonresident alien employee. The 2020 tax year in canada runs from january 2020 to december 2020 with individual tax returns due no later than the following april 30 th 2021. The 2020 federal income tax brackets on ordinary income.

105 429 36 of taxable income above 445 100. 205 901 321 600. 2021 tax year 1 march 2020 28 february 2021 see the changes from the previous year taxable income r rates of tax r 1 205 900. Calculate the tax savings your rrsp contribution.

Therefore only schedule 8 statement of formulas for calculating study and training support loans components nat 3539 and study and training support loans weekly fortnightly and monthly tax tables were updated for the 2019 20 year.