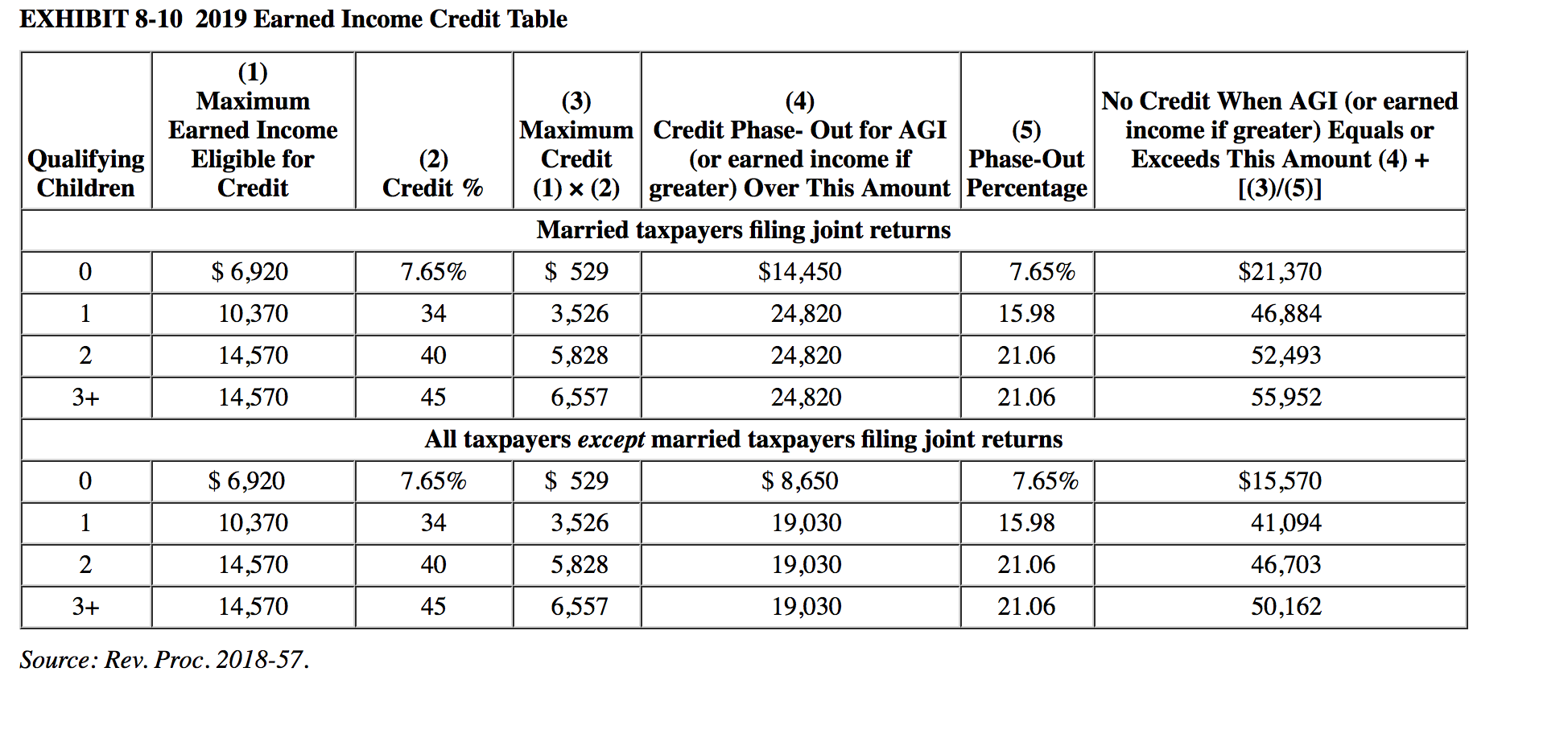

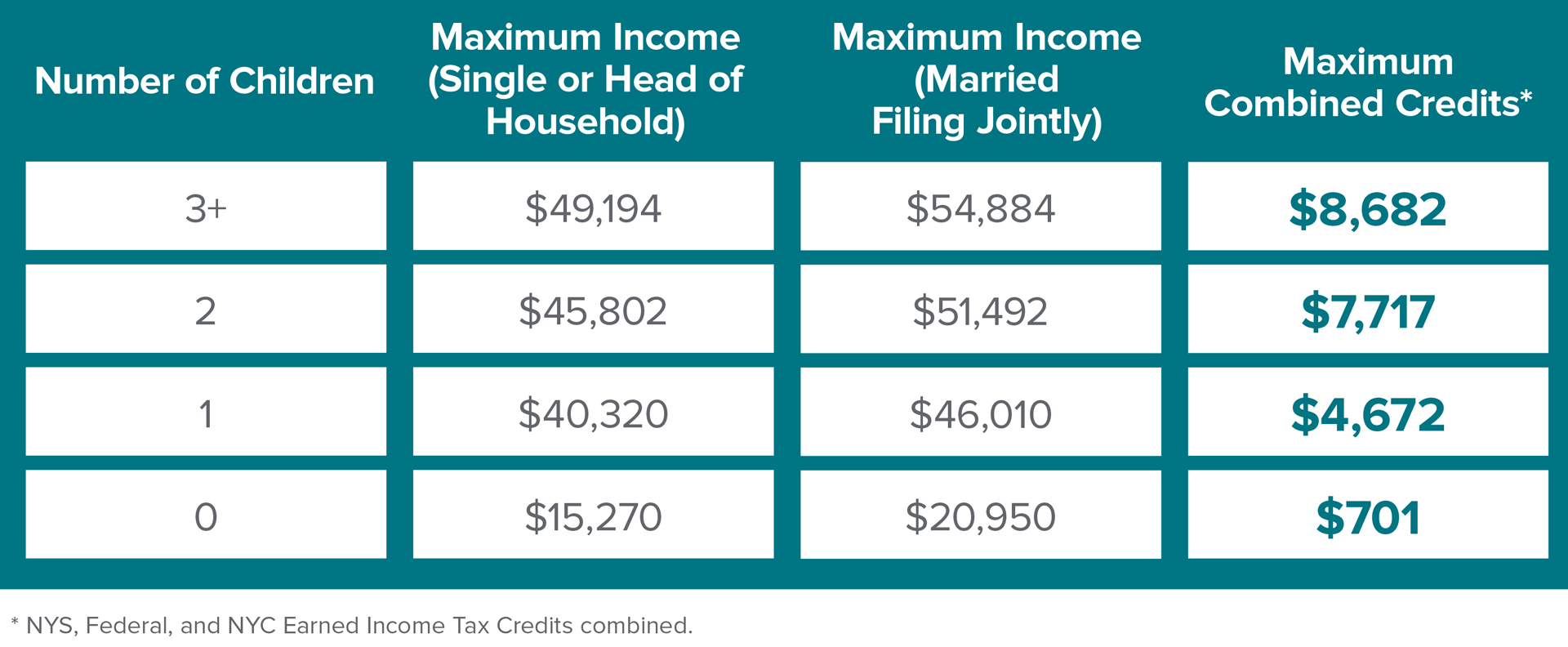

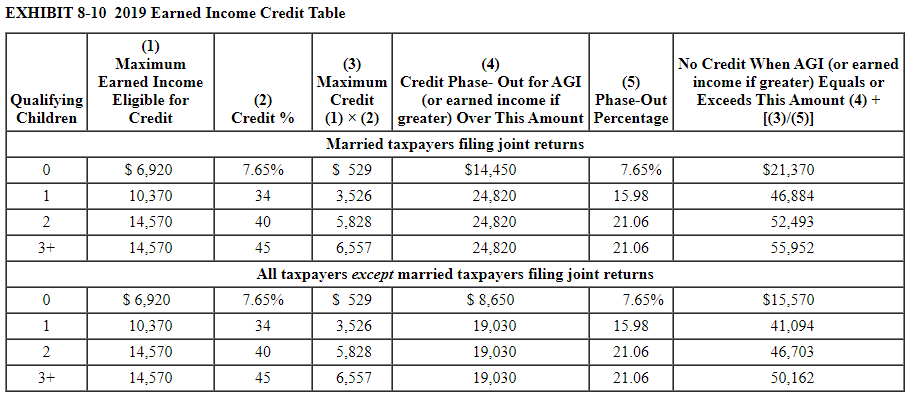

Earned Income Credit Table

Earned income credit eic table form 1040 instructions html.

Earned income credit table. Earned income credit publication 596 is the irs publication issued to help taxpayers understand earned income credit eic. Earned income credit eic table form 1040 instructions page 53. Tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr. To qualify you must meet certain requirements and file a tax return even if you do not owe any tax or are not required to file.

See the eic earned income credit table amounts and how you can claim this valuable tax credit. It includes eligibility requirements worksheets the eic table and several detailed examples. It s fast simple and secure. Eitc table eic table.

Earned income credit eic table form 1040 instructions html. Eitc reduces the amount of tax you owe and may give you a refund. The earned income tax credit is available to claim for the 2019 2020 tax season. Freefile is the fast safe and free way to prepare and e le your taxes.

Enter the credit from that column on your eic worksheet. If your filing status is single you have one qualifying child and the amount you are looking up from your eic worksheet is 2455 you would enter 842. Earned income credit eic 2017 eic table.