Eic Table

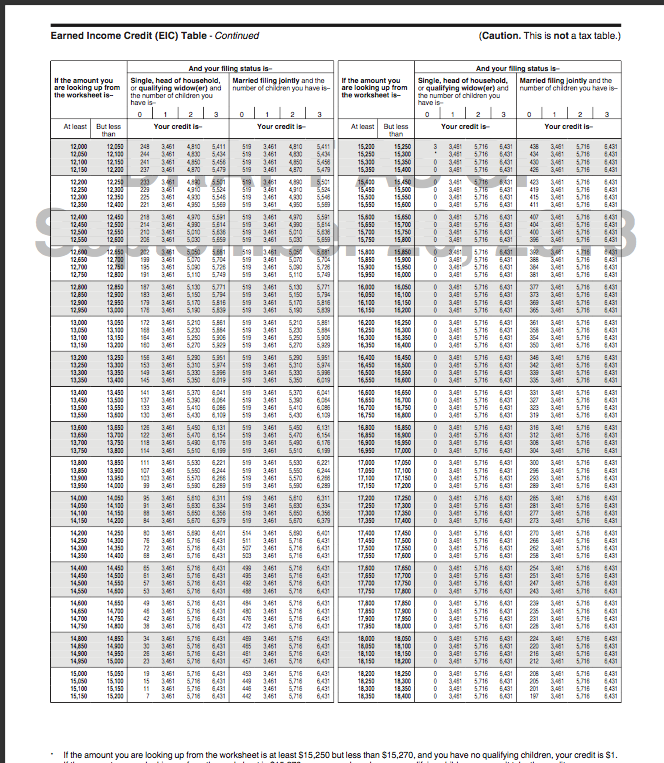

Read down the at leastbut less than columns and find the line that includes the amount you were told to look up from your eic worksheet earlier.

Eic table. The earned income tax credit eitc or eic is a benefit for working people with low to moderate income. Can i claim the eic. To claim the eic you must meet certain rules. Enter the credit.

2018 2019 2020 chart credit earned how income much table tax. Enter the credit from that column on your eic. The earned income tax credit is available to claim for the 2019 2020 tax season. Eicdatastream makes tracking projects quick and easy.

This is not a tax table. To access this publication. See the eic earned income credit table amounts and how you can claim this valuable tax credit. You will not be eligible if you earned over 5488400 or if you had investment income that exceeded 310000.

To find your credit read down the at least but less than columns and find the line that includes the amount you were told to look up from your eic worksheet. Follow the two steps below to find your credit. It includes eligibility requirements worksheets the eic table and several detailed examples. Trusted since 2000 global all sector coverage customise your dashboard choose the sectors you want to see current and reliable data reviewed and updated daily flexible search criteria for projects.

A tax credit usually means more money in your pocket. 2016 earned income credit eic table caution. Capex and opex weve got it covered. Here is the most current eic earned income credit table.

If the if the if the amount you and you listed amount you and you listed. Although an incredible number of families currently claim this valuable tax break the irs says many more qualify for this refundable tax credit yet neglect to take advantage of it. Eitc reduces the amount of tax you owe and may give you a refund. Then go to the column that includes your filing status and the number of qualifying children you have.

These rules are summarized in table 1. The credit maxes out at 3 or more dependents. 2018 earned income credit eic table caution. Then read across the column for your filing status single or married filing jointly.

This is not a tax table. To qualify you must meet certain requirements and file a tax return even if you do not owe any tax or are not required to file. The eic may also give you a refund. It reduces the amount of tax you owe.

Earned income credit in a nutshell. The guidelines for eic earned income credit table were recently increased. Earned income tax credit credit table. Earned income credit table eic table publication 596 is the irs publication issued to help taxpayers understand earned income credit eic.