Federal Income Tax Irs Tax Tables 2019

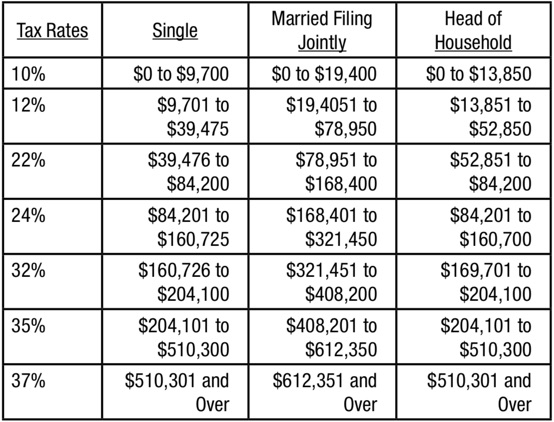

There are seven tax rates ranging from 10 to 37 as of 2020.

Federal income tax irs tax tables 2019. Federal income tax rates are determined by your filing status and your taxable income for the year your adjusted gross income minus either your standard deduction or allowed itemized deductions. This booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr. The top marginal income tax rate of 396 percent will hit taxpayers with taxable income of 418400 and higher for single filers and 470700 and higher for married couples filing jointly. 2019 income tax brackets and rates.

Booklet 1040tt contains the 2019 tax and earned income credit tables used to calculate income tax due on federal form 1040 and form 1040 sr. This booklet does not contain any tax forms department f ohe trteasury ntiernal evr enue service wwwrisgov 104. Instructions booklet 1040tt does not contain any income tax forms. 1040 tax and earned income credit tables introductory material 1040 tax and earned income credit tables main contents tax table.

View 2019 and 2020 irs income tax brackets for single married and head of household filings. Below are the 2019 irs tax brackets. Freefile is the fast safe and free way to prepare and e le your taxes. Prior to that the standard cpi was used to adjust the brackets 2019 tax brackets.

In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. Taxpayers can get the most out of various tax benefits and get useful tips on preparing their 2019 federal income tax returns by consulting a free comprehensive tax guide available on irsgov. It s fast simple and secure. The tax rate increases progressively the more you earn and is divided into income tax brackets.

Note that the updated tax rates and brackets would only apply for the 2019 tax year filed in 2020. The usual deadline is june 15. June 15 tax deadline postponed to july 15 for taxpayers who live abroad the internal revenue service in ir 2020 109 reminded people who live and work abroad that they have until wednesday july 15 2020 to file their 2019 federal income tax return and pay any tax due. Note 2020 tax bracketsincome thresholds are now based on the more accurate chained consumer price index cpi formula the irs has been mandated to use.

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)