Federal Income Tax Tables 2020

From 2020 and beyond the internal revenue service will not release federal withholding tables publication 15.

Federal income tax tables 2020. The 2020 federal income tax brackets on ordinary income. This page has the latest federal brackets and tax rates plus a federal income tax calculator. They are not the numbers and tables that youll use to prepare your 2019 tax returns in 2020 youll find them here. Publication 15 t will be posted on irsgov in december 2019 as will publication 15 employers tax guide.

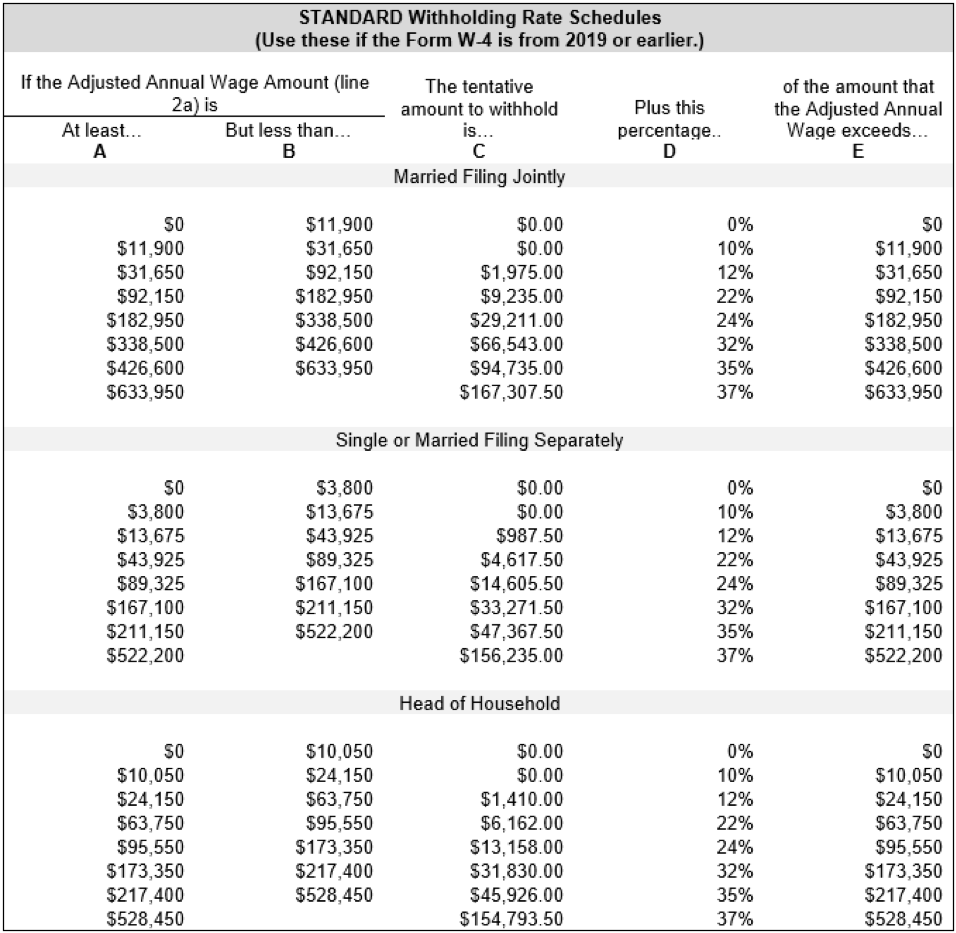

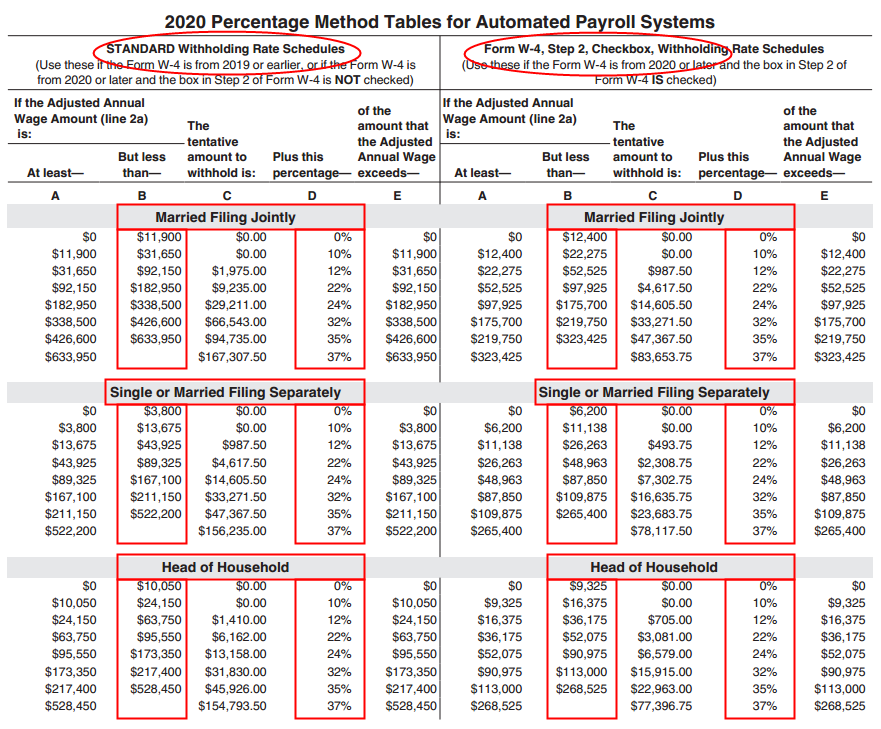

Tables for percentage method of withholding. These are the numbers for the tax year 2020 beginning january 1 2020. The tables include federal withholding for year 2020 income tax fica tax medicare tax and futa taxes. View 2019 and 2020 irs income tax brackets for single married and head of household filings.

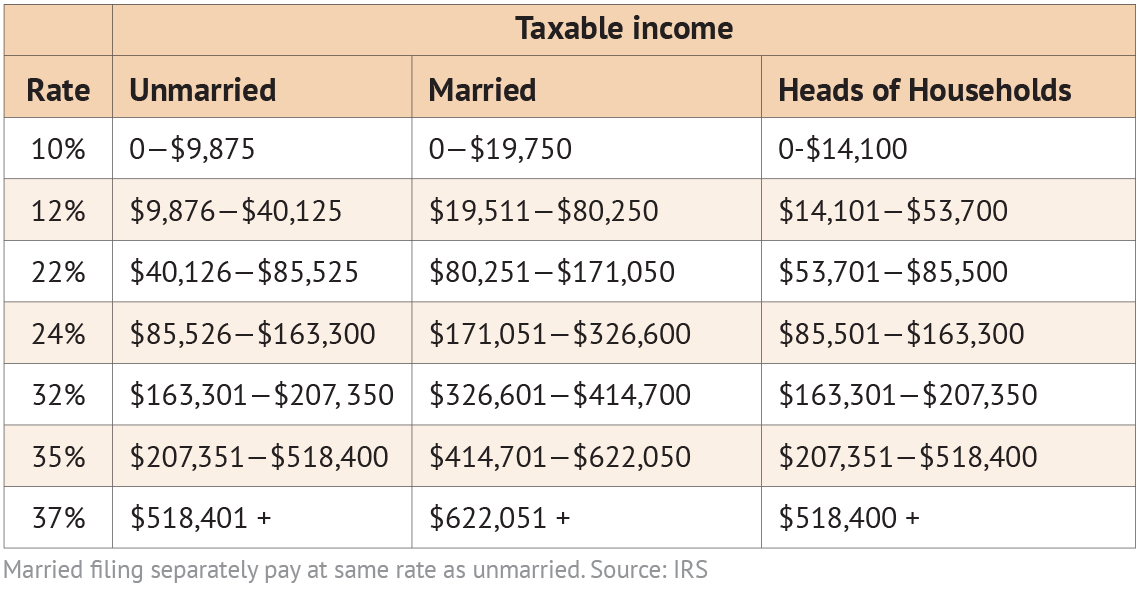

The income tax rates and thresholds used depends on the filing status used when completing an annual tax return. 10 tax rate up to 9875 for singles up to 19750 for joint filers 12 tax rate up to 40125. 10 12 22 24 32 35 and 37. Federal 2020 income tax ranges from 10 to 37.

For wages paid in 2020 the following payroll tax rates tables are from irs publication 15 t. You will also find supporting links to federal and state tax calculators and additional useful information to assist with calculating your tax return in 2020. Federal income tax rates and thresholds are used to calculate the amount of federal income tax due each year based on annual income. You should also include the two conditions that taxpayers are certifying that they meet.

Below are early release copies of percentage method tables for automated payroll systems that will appear in publication 15 t federal income tax withholding methods for use in 2020. 2020 federal income tax rates and thresholds. Income tax tables and other tax information is sourced from the federal internal revenue service. Instead you will need to look for the publication 15 t.

Your bracket depends on your taxable income and filing status.