Inherited Ira Rmd Table

1 of the year in which the first roth ira contribution was made.

Inherited ira rmd table. If the ira was worth 100000 at the end of 2019 your required minimum distribution for 2020 would be 3185 100000 314. For an inherited ira received from a decedent who passed away after december 31 2019. Spouse beneficiaries who do not elect to roll the ira over or treat it as their own also use the single life table but. If you choose to transfer the assets to an inherited ira the amount of your rmds will be based on your age and be recalculated each year based on the factors in the irs single life expectancy table.

Distribute over spouses life using table i use spouses current age each year or. This calculator determines the minimum required distribution known as both rmd or mrd which is really confusing from an inherited ira based on the irs single life expectancy table. Also note that inherited roth. Ira owner dies on or after required beginning date.

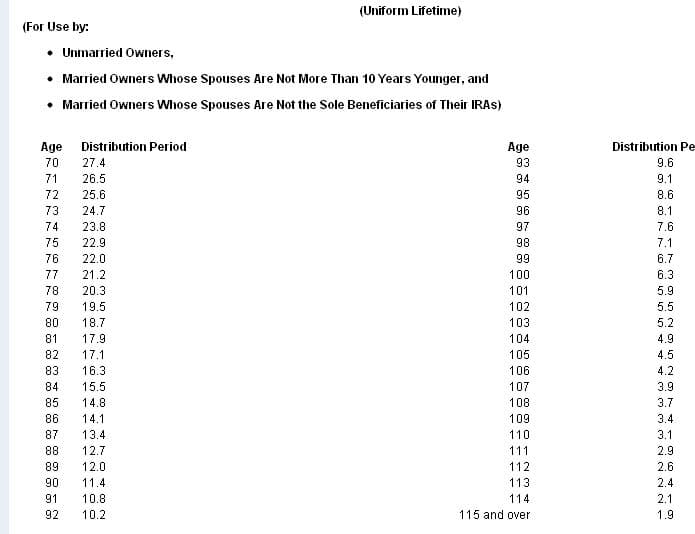

Early retirement rule 72t. You can find that table in the appendix here. Single life table for inherited iras. Designated beneficiaries use this single life expectancy table based on their age in the year after the ira owners death.

Reduce beginning life expectancy by 1 for each subsequent year. Distribute based on owners age using table i. That factor is reduced by one for each succeeding distribution year. Inherited ira rmd mrd.

You must take out your first required minimum distribution by april 1 of the year after you turn 70. Spousal distributions from inherited ira. For all subsequent years you must take the money out of your accounts by december 31. You are 53 years old in 2020 which is the year following your fathers death.

Transfer the assets to an inherited ira. Since beneficiary of such a retirement plan could be an infant this required minimum distribution table starts at age 0. This next rmd table is used for people who inherit iras or qualified plan balances. Required minimum distribution aka minimum required distribution calculator.

2019 single life table for inherited iras. Generally a designated beneficiary is required to liquidate the account by the end of the 10th year following the year of death of the ira owner this is known as the 10 year rule. A benefit of this option is that distributions from an inherited ira no matter what your age are not subject to the 10 early withdrawal penalty. Use of the rmd beneficiary table.

Spouse may treat as hisher own or. Ira required minimum distribution table 2020. Use owners age as of birthday in year of death. Note that the minimum is different for spouses and non spouse beneficiaries.

If you inherit a roth ira it is completely tax free if the owner held any roth iras for at least five years starting jan.