Irs Single Life Expectancy Table

Appendix b life expectancy tables.

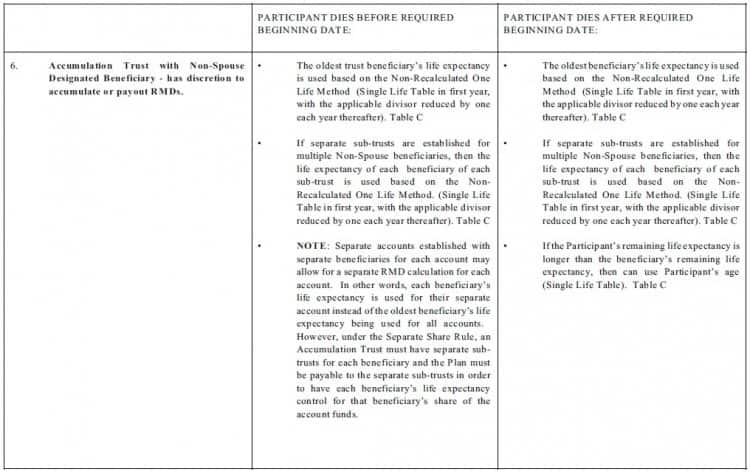

Irs single life expectancy table. Reduce beginning life expectancy by 1 for each subsequent year take entire balance by end of 5th year following year of death table 1 single life expectancy appendix b publication 590 b. These tables are included to assist you in computing your required minimum distribution amount if you havent taken all your assets from all your traditional iras before age 70 1 2. Spouse beneficiaries who do not elect to roll the ira over or treat it as their own also use the single life table but they can look up their age each year. The information provided by fidelity investments is general in nature and should not be considered legal or tax advice.

Irsgov english irsgovspanish espanol irsgovchinese irsgovkorean irsgovrussian pusskiy. The payments end at death. Designated beneficiaries use this single life expectancy table based on their age in the year after the ira owners death. That factor is reduced by one for each succeeding distribution year.

Options for a spousal inherited ira getting your financial ducks in a row says. Publication 590 individual retirement arrangements iras appendices. The first annuitant re ceives a definite amount at regular intervals for life. 66303u distributions from individual retirement arrangements iras for use in preparing 2019 returns get forms and other information faster and easier at.

Joint and survivor annuities. You receive definite amounts at regular intervals for life. December 6 2009 at 533 pm the ira where it is and begin taking distributions based upon your own life see table i for the factors. Fidelity does not provide legal or tax advice.

These actuarial tables do not apply to valuations under chapter 1 subchapter d relating to qualified retirement arrangements nor to section 72 relating to computations for exclusion ratios for annuities and for certain other limited purposes as provided by regulations at 17520 3a 207520 3a and 257520 3a.