Irs Withholding Tables

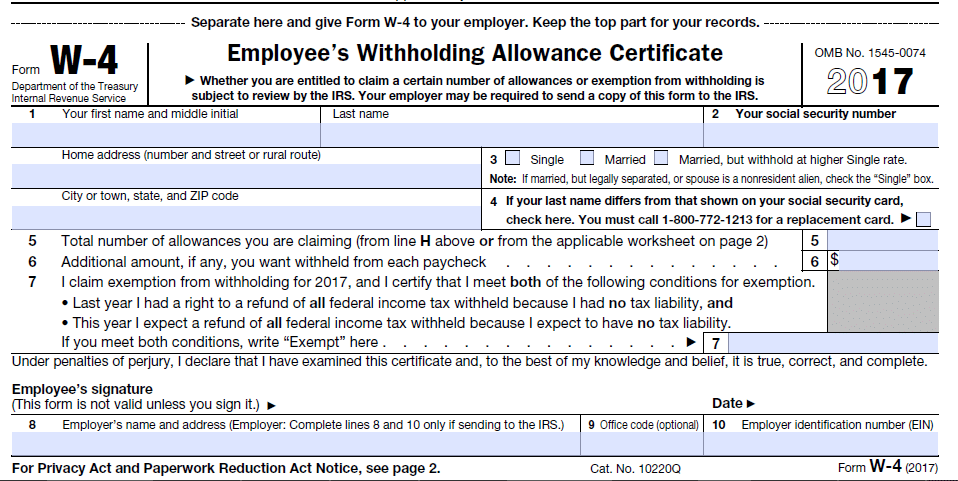

Under the tax cuts and jobs act tcja and effective january 1 2018 through december 31 2025 the personal exemption deduction is suspended.

Irs withholding tables. Youve come to the right placehere youll find guidance on 2019 withholding tables including 2019 tax withholding changes 2018 federal tax withholding tables and other withholding changes information. For help with your withholding you may use the tax withholding estimator. 15 b employers tax guide to fringe benefits contains information about the employment tax treatment and valuation of various types of noncash compensation. Withholding tables change every year to account for inflation.

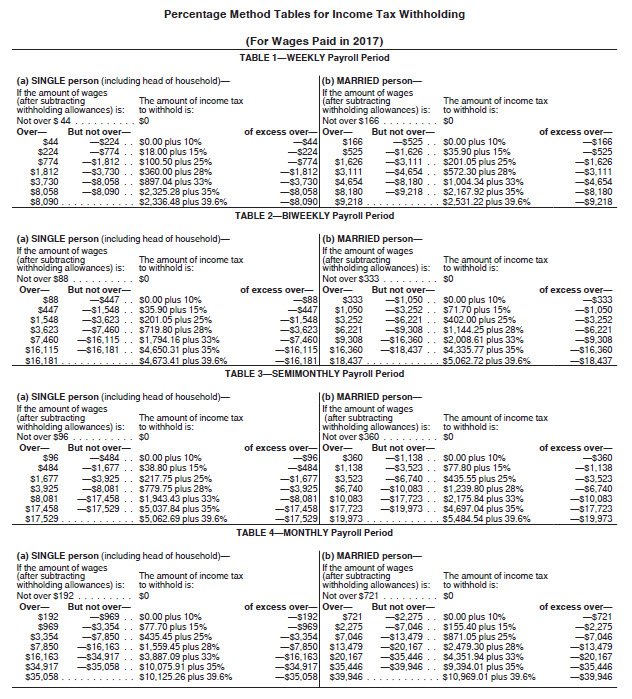

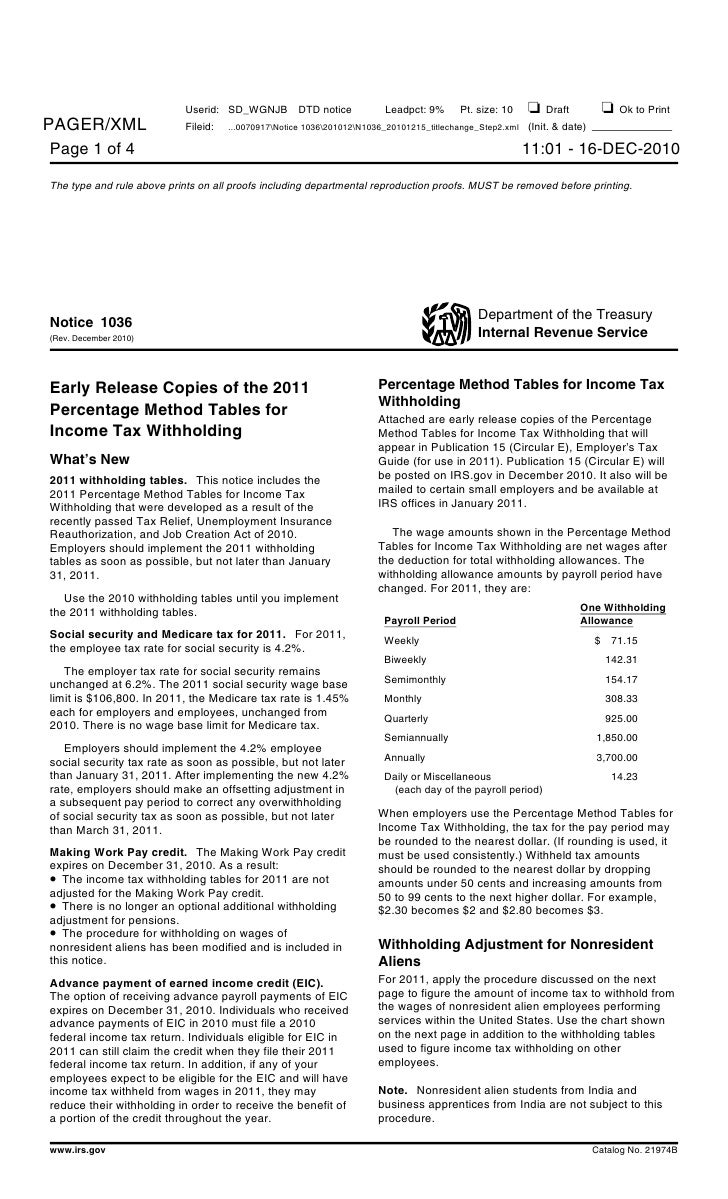

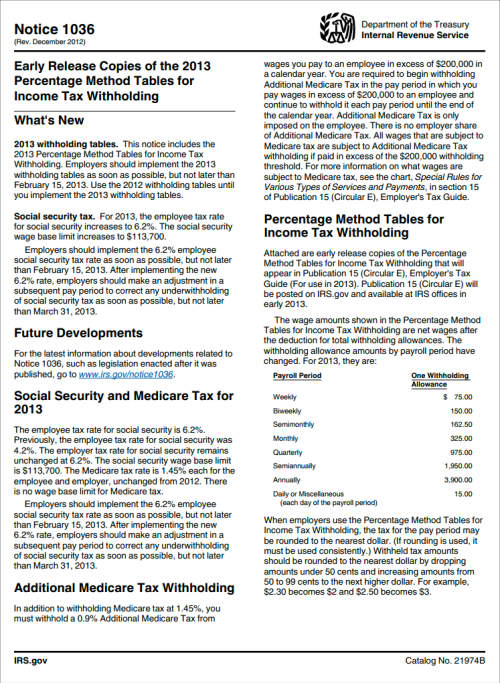

The irs publication 15 includes the tax withholding tables. Like past years the irs released changes to the income tax withholding tables for 2020. Notice 2018 92 2018 51 irb. The irs publication 15 t gives employers everything they need to know about tax withholdings.

However the irs will not be modifying. Publication 15 t will be posted on irsgov in december 2019 as will publication 15 employers tax guide. In this example the employer would withhold 32 in federal income tax from the weekly wages of the nonresident alien employee. These changes are in response to the tax cuts and jobs act of 2017.

2019 form w 4 notice. Ever wonder if tax withholding guidelines change from year to year. 15 t includes the federal income tax withholding tables and instructions on how to use the tables. Tax reform and irs withholding.

The irs has released publication 15 circular e employers tax guide containing the federal income tax withholding formula and tables as well as other employer guidance for tax year 2019. 1038 available at irsgovirb 2018 51irbnot 2018 92 provides that until april 30 2019 an employee who has a reduction in a claimed number of withholding allowances. This publication includes the 2019 percentage method tables and wage bracket ta bles for income tax withholding. The internal revenue service irs has announced the annual inflation adjustments for the year 2020 including tax rate schedules tax tables and cost of living adjustments.

The employer will use worksheet 3 and the withholding tables in section 3 to determine the income tax withholding for the nonresident alien employee. In addition to new wage brackets there are significant changes to how employers will handle tax withholding. Instead you will need to look for the publication 15 t. From 2020 and beyond the internal revenue service will not release federal withholding tables publication 15.

You can use the tax withholding estimator to estimate your 2020 income tax. The tax withholding estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your employer.