Federal Tax Tables 2020 Irs

Jan 22 2020 cat.

Federal tax tables 2020 irs. Note that the updated tax rates and brackets would only apply for the 2019 tax year filed in 2020. Ir 2019 180 november 6 2019 the irs today announced the tax year 2020 annual inflation adjustments for more than 60 tax provisions including the tax rate schedules and other tax changes. Freefile is the fast safe and free way to prepare and e le your taxes. The maximum earned income tax credit in 2020 for single and joint filers is 538 if there are no children table 5.

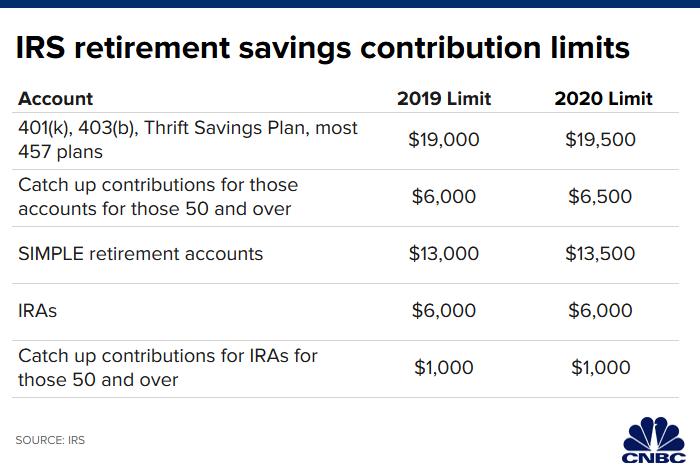

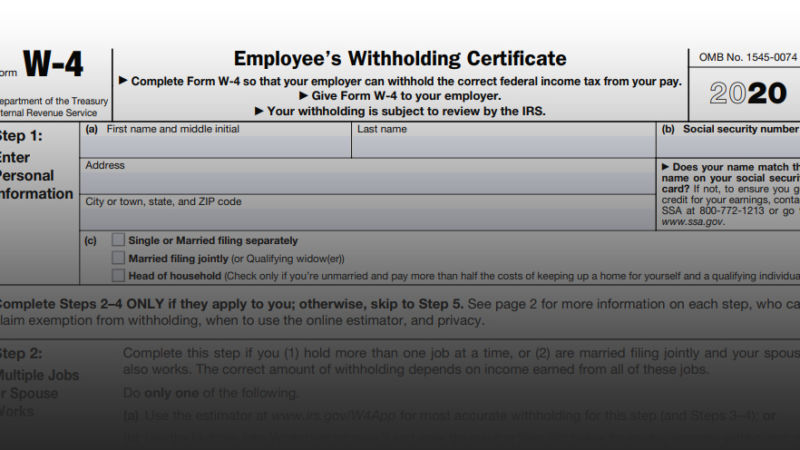

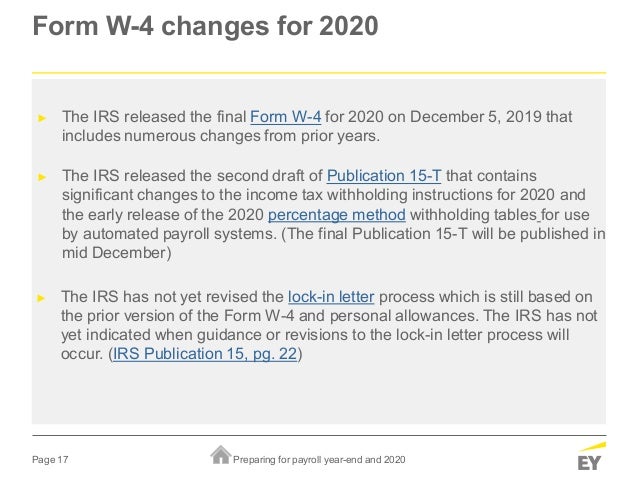

It s fast simple and secure. Employers quarterly federal tax return. Use the tax withholding estimator. Early release copies of percentage method tables for automated payroll systems that will appear in publication 15 t federal income tax withholding methods for use in 2020.

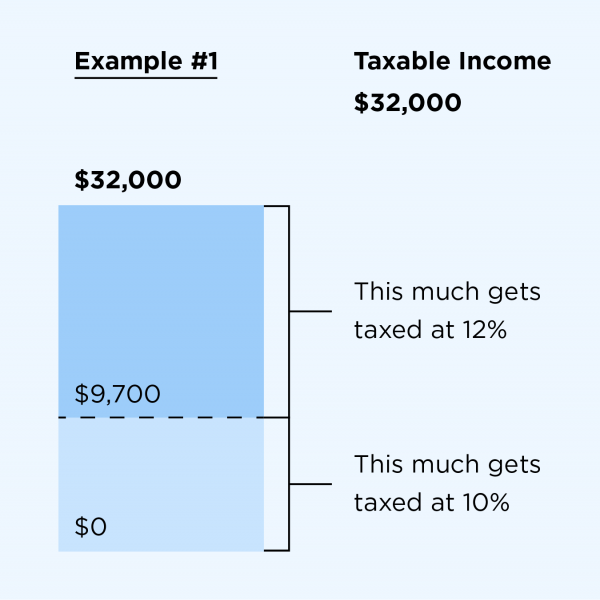

Currently some screen reader users may experience difficulty when navigating the tax withholding estimator with jaws versions jaws17 jaws18 and jaws 2020 on ie11 and are recommended to use a different browser until fixed. The maximum credit is 3584 for one child 5920 for two children and 6660 for three or more children. Note 2020 tax bracketsincome thresholds are now based on the more accurate chained consumer price index cpi formula the irs has been mandated to use. Below are the 2019 irs tax brackets.

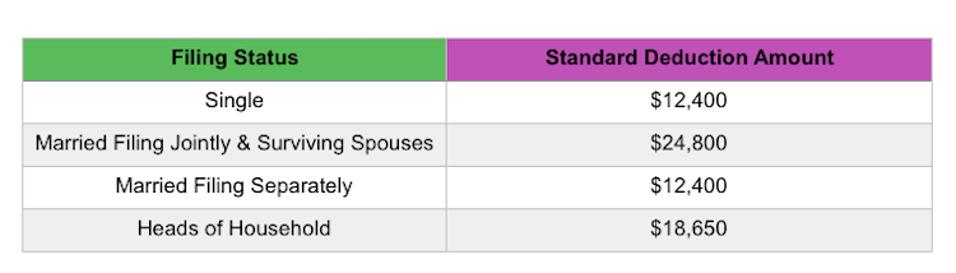

Employers who withhold income taxes social security tax or medicare tax from employees paychecks or who must pay the employers portion of social security or medicare tax. The internal revenue service irs has announced the annual inflation adjustments for the year 2020 including tax rate schedules tax tables and cost of living adjustments. 24327a 2 0 1 9 tax year tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr. Employers use publication 15 t to figure the amount of federal income tax to withhold from their employees wages.

Go to irs. If the nonresident alien employee was first paid wages before 2020 and has not submitted a form w 4 for 2020 or later add the amount shown in table 1 to their wages for calculating federal income tax withholding. Tax table from instructions for form 1040 pdf schedules for form 1040 form 1040 sr pdf.